Exploring the changes to the innovation grants, R&D Tax and venture-lending landscape

Innovation incentives, such as grants and R&D tax credits, play a crucial role in driving economic impact for the UK. In recent years, these have led to the creation of approximately 150,000 new jobs, particularly in highly skilled sectors like biotechnology, medical equipment, engineering, life sciences, and high-tech manufacturing. Sitting alongside these sources of non-dilutive funding is innovation debt, a key piece of the venture funding landscape that some businesses overlook. But how was the recent changes to the Budget impacted this funding landscape?

Grant Funding

Grants stimulate significant economic growth, contributing £43 billion in turnover for UK companies. This growth comes from productivity increases, jobs growth, greater investor confidence as well as prestige. The return on investment is also substantial, with every £1 of grant funding generating a return of £7.50 to £8 for the UK economy. This highlights the importance of innovation incentives in fostering economic development and enhancing productivity.

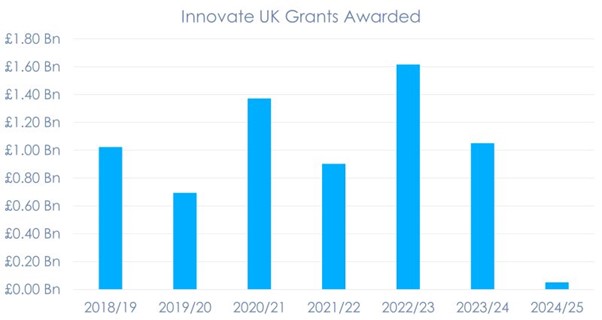

However, this fiscal year has seen a 10x drop in grant funding compared to previous years across a similar period.

The yearly Innovate UK R&D grant investment should average ~£1.2bn, but from April 2024 to October 2024, only £50m has been awarded. It is unclear to what extent reductions to capital expenditure grant funding has been, but given the year-long delay of the £185m flagship decarbonisation fund IETF, it is likely only ~£150m of capital projects will be granted in 2024/25.

A likely reason for this absence of essential funding is the change in government, which may have only delayed funding, rather than abandoned it completely. Nevertheless, a 10x reduction in grants this financial year means competition for grants has increased greatly, so a specialist grant advisor is essential.

R&D Tax credits

Despite numerous changes to the wider tax landscape, thankfully R&D tax credits have remained in place. These credits significantly boost investment in research and development, with every £1 spent on these credits leading to an additional £1.53 to £2.35 in R&D spending by UK companies. In the 2021-22 fiscal year, £7.6 billion in R&D tax relief supported £44.1 billion in R&D expenditure, driving economic growth through technological advancements. Companies that consistently invest in R&D are predicted to be 13% more productive, enhancing overall economic efficiency and competitiveness. However, changes to legislation in recent years has increased the scrutiny by HMRC and the reporting quality needed to claim funding. Working with a specialist consultant to justify the technical eligibility, not just the financial ones is essential to navigate the changing landscape. You can read more about the changes here.

Venture Debt

Lending money to profit-making and revenue generating businesses is well established, but financing the high-R&D pre-revenue SME market is still a relatively new market. According to the British Business Bank, 43% of UK SMEs perform innovation and yet 26% of those SMEs are not-yet-profit-making. Generally, innovation loans are less expensive that venture capital and contribute to a more even way to finance a business as you do not have to give up equity. Innovate UK has started to offer loans to businesses and this trend will continue as it partners with professional debt lenders. FI Group partners with SPRK Capital, a market leader in UK venture lending, to offer businesses access to wider non-dilutive funding.

Talk to an FI Group Expert

If you are wondering how to fund your business’s innovation, speak to FI Group, specialists in securing grants and R&D tax credits. Our technical and financial experts keep on top of the ever changing legislative landscape to maximise the funding you can secure, so you can grow your business. For more information on how to access innovation funding, or how the Budget may have impacted your business, speak to our team.