HMRC Compliance Impact on R&D Tax Claimants

In the face of ongoing economic uncertainties in 2024, businesses are increasingly reliant on R&D tax credits to fuel innovation and maintain competitiveness. This white paper examines the latest HMRC compliance statistics and their implications for R&D tax claimants, emphasising the need to adopt an in-year approach as per HMRC’s guidance released on 31st October 2023.

Key Statistics and Commentary

Increase in Compliance Workforce

- 2020/2021: 100 compliance workers

- 2023/2024: 500 compliance workers

- Increase: +500%

Commentary: The significant increase in compliance workforce reflects HMRC’s intensified focus on scrutinising R&D tax claims. For claimants, this means a higher likelihood of facing compliance checks, necessitating meticulous documentation and adherence to guidelines. Adopting an in-year approach can help businesses stay aligned with HMRC’s expectations and reduce the risk of non-compliance.

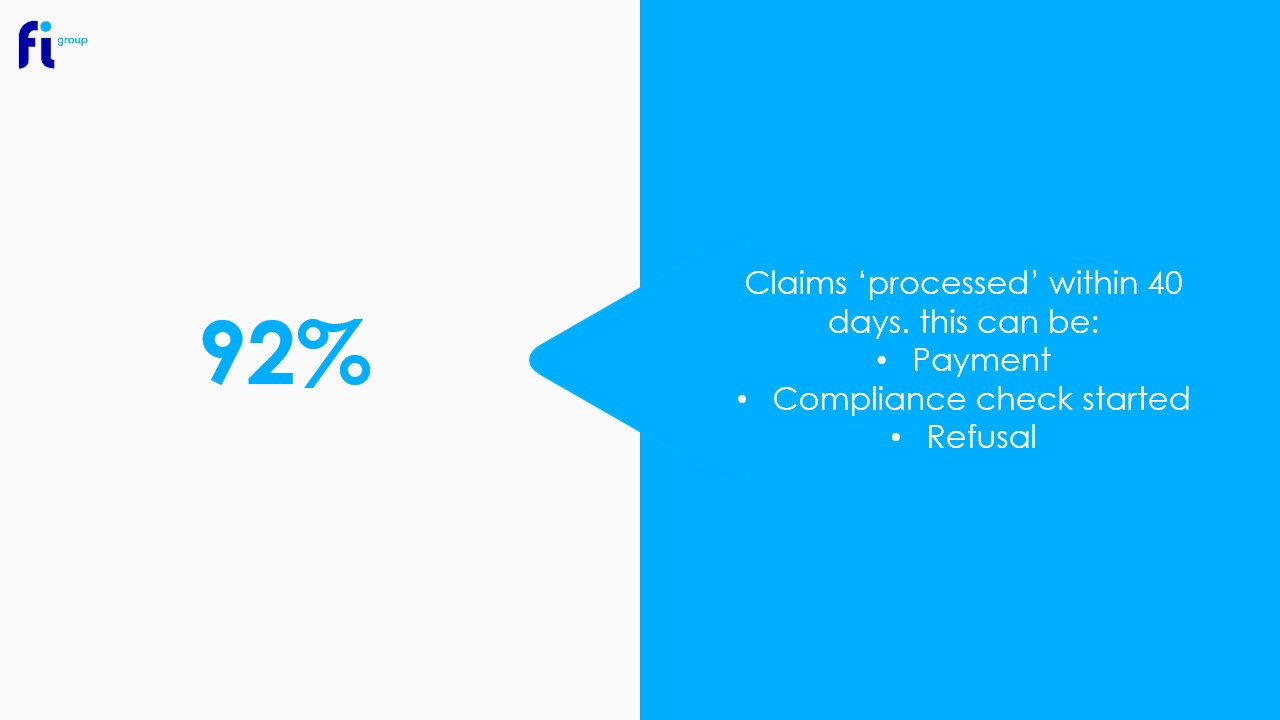

Processing Time for Claims

- Claims processed within 40 days: 92%

Commentary: While a high percentage of claims are processed within 40 days, the definition of ‘processed’ includes payment, compliance check initiation, or refusal. This ambiguity can create uncertainty for claimants. An in-year approach allows businesses to continuously monitor and update their claims, ensuring they are prepared for any compliance checks and reducing potential delays.

Compliance Checks for Large Companies

- All claims by large companies checked: 100%

Commentary: Large companies must be particularly vigilant, as every claim undergoes deep scrutiny. This underscores the importance of robust internal processes and thorough record-keeping. By adopting an in-year approach, large companies can ensure ongoing compliance and be better prepared for HMRC’s scrutiny.

Increase in Compliance Checks

- Claims going to compliance check: 17% (up from 10% the previous year)

Commentary: The rise in compliance checks indicates a more stringent review process. Claimants should be prepared for increased scrutiny and ensure their claims are well-supported by detailed evidence of qualifying R&D activities. An in-year approach facilitates regular updates and reviews of R&D activities, making it easier to provide accurate and comprehensive documentation.

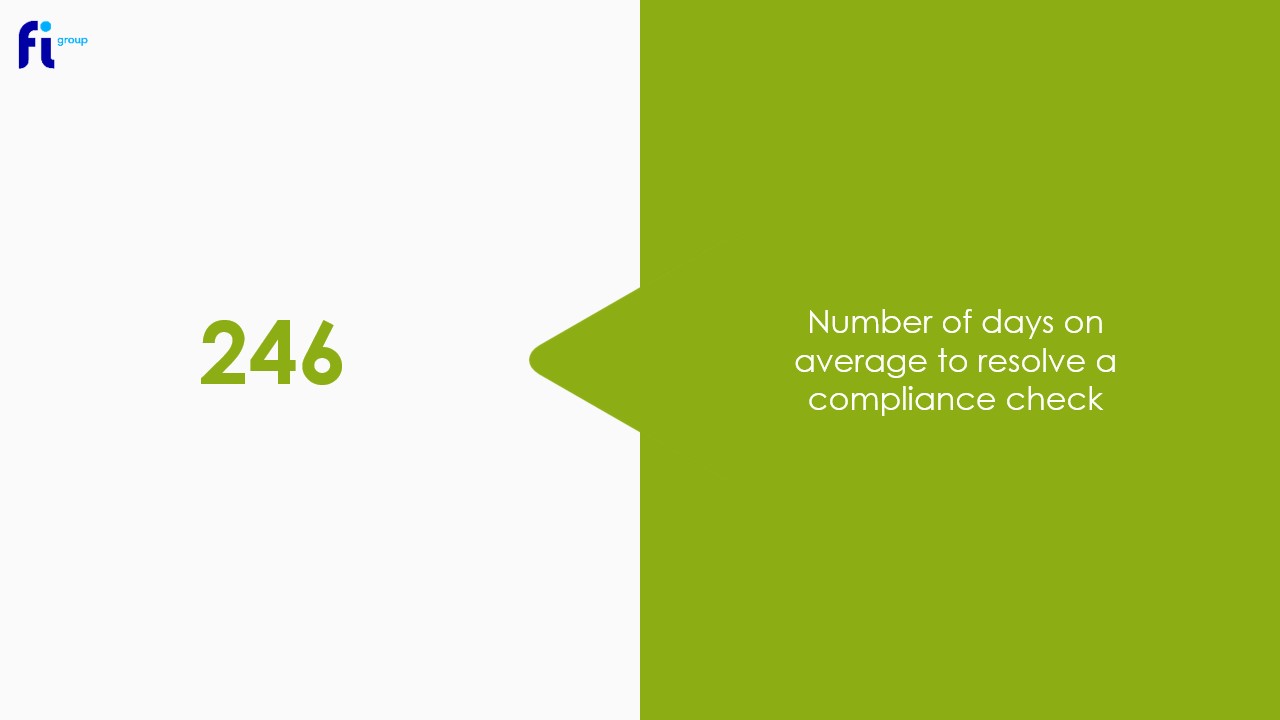

Average Resolution Time for Compliance Checks

- Average days to resolve a compliance check: 246

Commentary: The lengthy resolution time for compliance checks can pose cash flow challenges for businesses, particularly in a tight economic climate. Companies should plan for potential delays and consider the financial impact of prolonged compliance processes. An in-year approach helps mitigate these challenges by ensuring claims are continuously updated and ready for review, potentially speeding up the resolution process.

Reduction in Claims During Compliance Checks

- Proportion of claims reduced: 77%

Commentary: A high proportion of claims are reduced during compliance checks, highlighting the critical need for accuracy and thoroughness in claim preparation. Businesses must ensure their claims are fully compliant to avoid reductions and potential financial setbacks. Adopting an in-year approach allows for regular verification and correction of claims, reducing the likelihood of reductions during compliance checks.

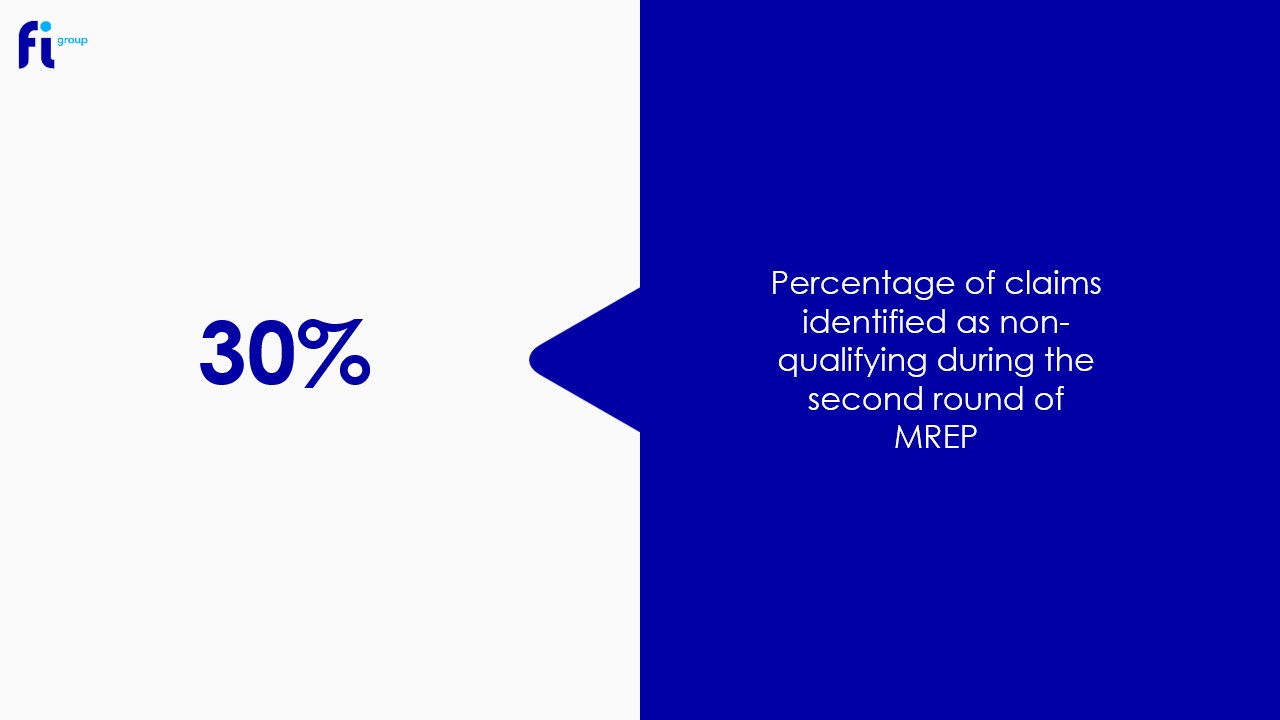

Non-Qualifying Claims and MREP

- Non-qualifying claims during second MREP round: 30%

- Claims reduced during second MREP round: 21%

Commentary: The MREP process reveals significant issues with claim qualifications, with a notable percentage of claims being reduced or identified as non-qualifying. This stresses the importance of understanding and adhering to HMRC’s criteria for R&D tax credits. An in-year approach ensures continuous alignment with HMRC’s guidelines, reducing the risk of non-qualifying claims.

HMRC Compliance Impact on R&D Tax Claimants: Fraud and Error Rates

- Fraud rate: <10%

- Error rate: Higher than fraud

Commentary: While fraud remains relatively low, errors are a more significant concern. This suggests that many businesses may be inadvertently making mistakes in their claims. Enhanced training and guidance on claim preparation could help reduce error rates. An in-year approach promotes regular review and correction of claims, minimising errors and improving overall compliance.

Alternative Dispute Resolution (ADR) Outcomes

- HMRC decision upheld in ADR cases: 85%

Commentary: The high rate of HMRC decisions being upheld in ADR cases indicates that HMRC’s initial assessments are generally robust. Claimants should ensure their claims are well-founded and consider ADR as a last resort. An in-year approach helps businesses maintain accurate and compliant claims, reducing the need for ADR.

Impact of 2024 Economic Challenges

The economic challenges of 2024, including inflationary pressures, supply chain disruptions, and market volatility, amplify the importance of R&D tax credits for businesses. However, the increased scrutiny and compliance requirements from HMRC necessitate a strategic approach to claiming these credits. Adopting an in-year approach, as recommended by HMRC, allows businesses to stay compliant, reduce errors, and ensure timely processing of their claims.

Conclusion: HMRC Compliance Impact on R&D Tax Claimants

Navigating the complexities of R&D tax credits in 2024 requires diligence and strategic planning. By adopting an in-year approach in line with HMRC’s guidance, businesses can maximise their R&D tax benefits and support their innovation efforts amidst economic challenges.

FI Group

FI Group specialises in helping businesses navigate the complexities of R&D tax claims, ensuring compliance with HMRC regulations. Our expert team provides comprehensive support throughout the entire process, from identifying eligible R&D activities to preparing and submitting claims. We stay up-to-date with the latest HMRC guidelines, including the recent emphasis on adopting an in-year approach, to maximise your claim’s success. Additionally, we offer tailored advice and strategic planning to optimise your R&D investments, ensuring you receive the full benefits of available tax incentives. Let FI Group be your trusted partner in achieving R&D tax compliance and maximising your innovation potential.