HMRC has introduced a new disclosure service aimed at companies that may have inadvertently overclaimed Research and Development tax relief in previous years. This initiative comes in response to the significant levels of error and fraud identified in R&D tax relief schemes.

In an analysis of the 2020-21 claims, HMRC found that nearly one-quarter of SME scheme claims and 3.6% of RDEC scheme claims were incorrect or fraudulent, costing the Exchequer an estimated £1.13 billion. The new R&D disclosure service is specifically designed for companies that have made accidental overclaims and are unable to amend their tax returns due to time constraints.

Encouraging Voluntary Compliance

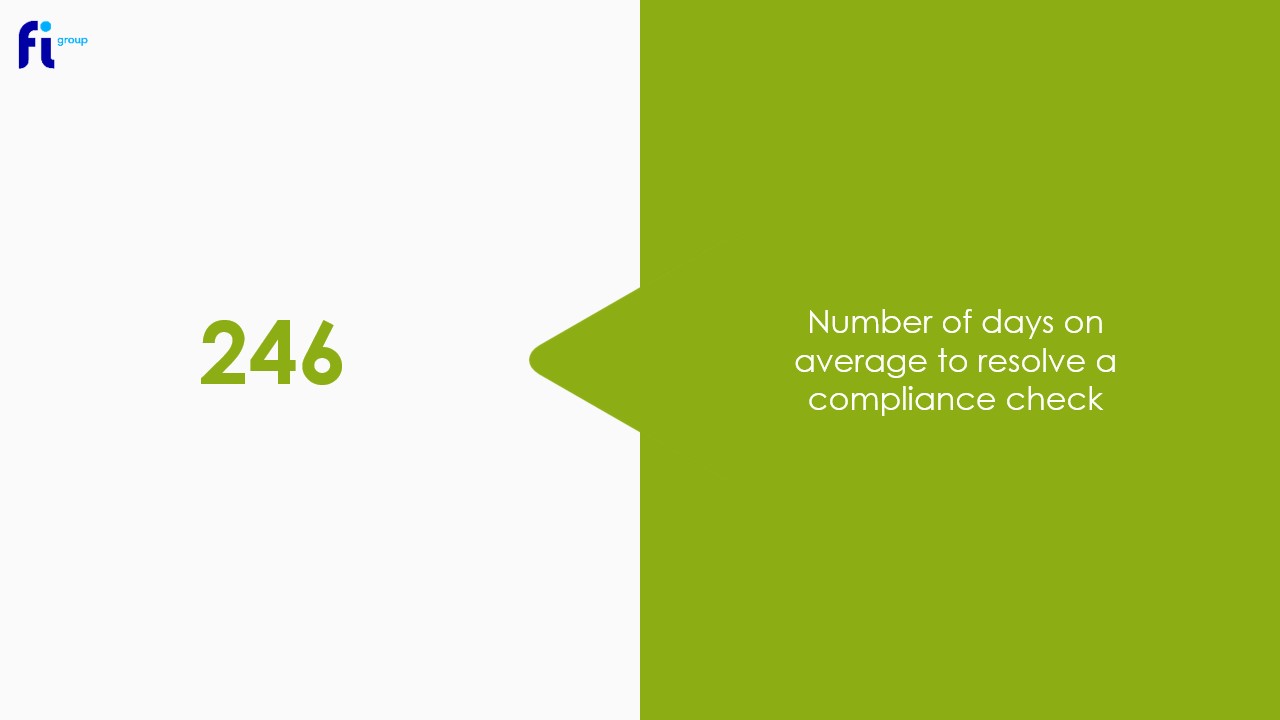

The disclosure service aims to encourage companies with historic inaccuracies to come forward voluntarily. However, it is not available to companies whose behaviour was deliberate or fraudulent. HMRC’s stance on non-compliant behaviour has become increasingly strict, as evidenced by the doubling of tax under consideration in R&D investigations to £641 million in the 2023/24 period. These enquiries can be very costly to a business, leading to long delays of payments and the risk that your claim amount can be reduced. Currently typical HMRC enquiries take on average 246 days to complete with 77% of claims being reduced during a check, read more on the impact of HMRC compliance checks here.

HMRC’s initiative to address historical inaccuracies in R&D claims is a positive step towards ensuring compliance and integrity in the system. While the new service provides a pathway for companies to rectify past errors, the lack of incentives and strict limitations may not fully encourage the desired level of voluntary disclosures. Given the complexities involved, it is crucial for companies to engage specialist R&D tax consultancies. Our R&D Tax experts can help identify any past errors and ensure compliance with HMRC’s stringent requirements, significantly reducing the risk of audits or rejections.

How the Disclosure Service Works

To make a disclosure, companies must submit an online form and upload their calculations. After submission, HMRC will either write to the company with a letter of acceptance or contact them for more information. Companies will receive a payment reference number within 15 calendar days of making their disclosure.

To access the disclosure service click here.

Looking Ahead

The launch of this service highlights HMRC’s commitment to addressing errors and fraud in R&D tax relief claims. Companies are encouraged to seek specialist advice from tax dispute specialists to ensure they approach HMRC correctly and use the most appropriate route for disclosure.

For more information about the new disclosure service or to understand the R&D Tax initiatives available to your company, contact FI Group today using the button below.