-

Clinical Trial Participants: A Comprehensive Guide to Calculating Costs in R&D Claims

Overview Clinical trial participants play a crucial role in the development of new medical treatments and therapies. This guide covers the key aspects of involving participants in clinical trials, including their definition, restrictions, and how to calculate R&D tax relief for their involvement. Who Are Clinical Trial Participants? Clinical trial participants are individuals who volunteer…

-

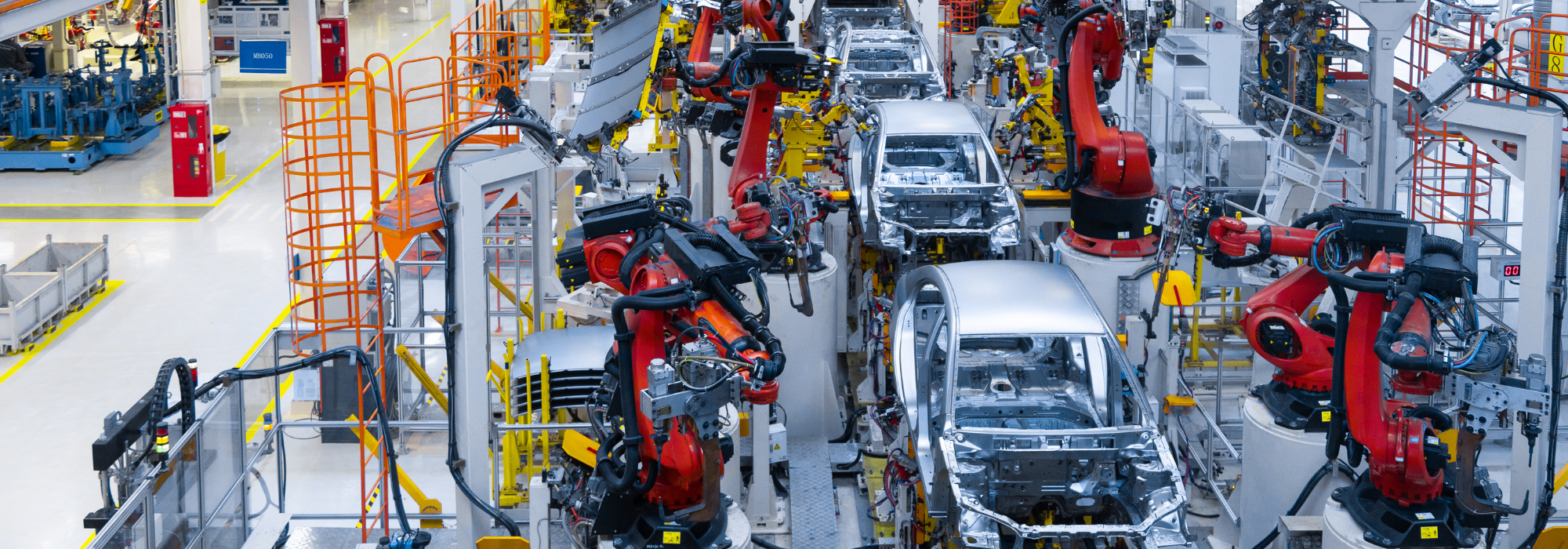

Consumable Costs in R&D Tax Credit Claims

Consumable Costs in R&D Tax Credit Claims: Your FI Group Guide R&D tax credits are a valuable incentive for companies investing in innovation. One of the key components are Consumable Costs in R&D Tax Credit Claims. Understanding what consumable costs can be included in R&D tax credit claims is crucial for maximising your benefit. This…

-

Software Licences in R&D Tax Credit Claims: What is Included?

R&D tax credits are a valuable incentive for companies investing in innovation. One of the key components of these claims is software licences. Understanding what software licences can be included in R&D tax credit claims is crucial for maximising your benefit. This guide provides a comprehensive overview of eligible software licences, ensuring you make the…

-

Understanding Contracted Activities in R&D Projects

Contracted Activities in R&D Projects: What are they? Contracted activities are a vital component of many research and development (R&D) projects. These activities are considered subcontracted when a company engages an external contractor to perform tasks that form part of a larger R&D project. Even if the subcontracted work isn’t R&D in isolation, it can…

-

Externally Provided Workers in R&D Claims: What’s Included?

An FI Group UK Guide: Externally Provided Workers in R&D Claims Externally Provided Workers in R&D claims are seen as the temporary staff supplied by third-party agencies. This guide covers the key aspects of EPWs, including their definition, restrictions, and how to calculate R&D tax relief for their services. What Are Externally Provided Workers in…

-

Staffing Costs in R&D Tax Credit Claims: What is Included?

An FI Group UK Guide: Staffing Costs in R&D Tax Credit Claims R and D tax credits are a valuable incentive for companies investing in innovation. One of the key components is working out staffing costs in R&D tax credit claims. Understanding what staffing costs can be included in R&D tax credit claims is crucial…

-

What Qualifies as R&D Expenditure?

And FI Guide: What Qualifies as R&D Expenditure R&D tax relief schemes are designed to encourage innovation by allowing businesses to claim back certain types of expenditure. Understanding what qualifies as R&D expenditure is crucial for maximising your claim. This and the subsequently linked guides outline the main categories of expenditure that can be claimed…

-

Grant Funding for Clinical Trials

Grant Funding for Clinical Trials Clinical trials are an important stage of R&D for new pharmaceuticals, treatments and medical devices, building up evidence for both safety and effectiveness in human participants. They are also required by regulators like the MRHA in the UK and the FDA in the US before you can start selling your…

-

A Guide to R&D Capital Allowances

What are R&D Capital Allowances? As a business owner in the UK, you’re likely facing challenges when it comes to funding your research and development (R&D) projects. The costs of innovation can be high, and you might be worried about how these expenses will impact your company’s financial health. R&D Capital Allowances are a type…