Starting any tech, software, or R&D-oriented business is always an uphill battle. Managing your time between working on your passion, sourcing investment, and deciding what the best avenue is to secure funding is a real challenge. One has to become an expert at spinning plates.

Startups often go down the venture capital (VC) route as it provides them with instant access to funds, allowing them to grow quickly, either by hiring staff or developing their product by investing in material and machine costs.

VC in a nutshell

VC funding ensures that investment does not stop after one round. Companies can continue their funding from Seed, or Angel, investment through to Series C. Multiple funding rounds offer companies time to grow, but they require constant feedback loops in which the ‘investee’ presents evidence of growth and improvement to the ‘investor’, often showing where funding has been allocated, and where the value lies in further investment. Startups, then, are in a race against the clock to show investors their worth, and to unlock further funding. This is understandable as VCs are spending external investor money and need to show where their returns lie.

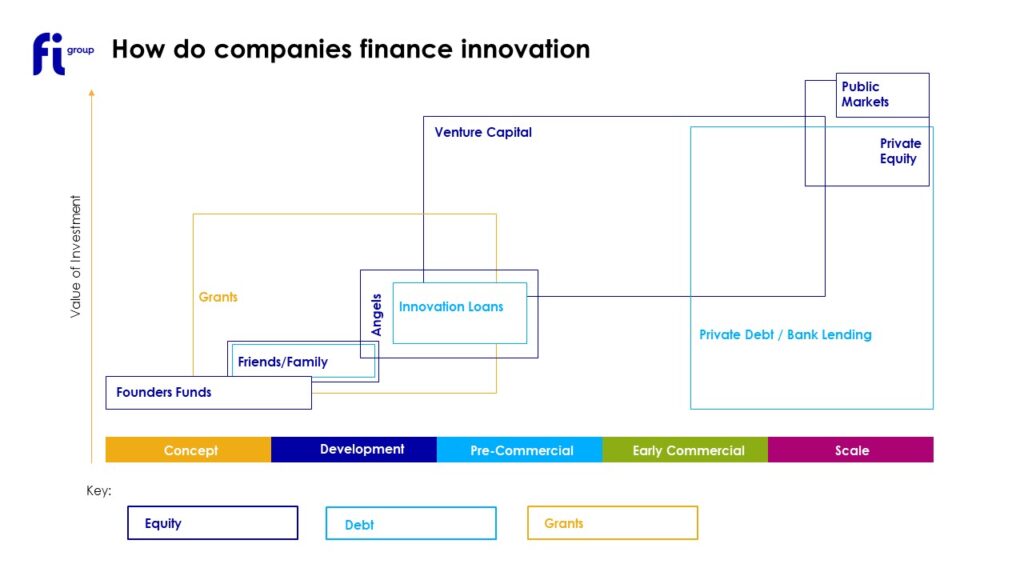

It would be a mistake to think that securing VC funding is the be-all and end-all of ensuring a company’s early success and development. At FI Group, we offer three types of support: R&D Tax, Debt financing, and grants. However, funding is not necessarily an exclusive practice, and, businesses may look to angel investors, private equity, and public markets as supplemental options.

For the purpose of this blog, we will focus on the benefits of R&D Tax, and how you can work alongside VC funding, and boost your credibility when presenting to investors.

The largest benefit to securing funding from HMRC through R&D Tax is how it protects your equity and prevents the devaluation of shares. It is true that HMRC has tightened the reins on paying out R&D Tax claims in the form of post-claim inquiries. However, this highlights the importance of partnering with a specialist advisor like FI Group, as our team of R&D Tax consultants can verify your R&D and defend any claim.

VC and R&D Tax Landscape Today

With summer coming to a close, VCs are expecting a substantial increase in the number of companies attempting to raise funds in the autumn. Early fundraising is advised for companies looking to gain VC investment alongside a 9-month cash runway to weather expected VC application backlogs. This is a prime example of how managing your R&D Tax claim can help ensure your company’s success. A well-timed R&D Tax application could provide businesses with a cash injection that will carry them to their next round of funding.

The UK R&D tax landscape is helping grow the VC funding pool, with the Enterprise Investment Scheme raising £2.3bn in funds between 2021-2022. This scheme, and others like it, are efforts from the government to cement the UK as a global player for innovation.

Interestingly, Europe is accountable for 16% of global VC investment, showcasing an 11% growth since 2003, which can be attributed to the exponential growth of software companies, and local government investment.

The value-add of R&D tax for a business is more than just a cash injection. Companies can use the funding to invest in growing their teams, which can add value ahead of later funding rounds and avoid a devaluation. Furthermore, this can act as a good backing for grant funding which can in turn expand IP and increase market share.

FI Group offers roadmapping services for grant applications, breaking down the path to success with available open grants. This service adds a level of transparency for investors and it can be incorporated into a company’s funding strategy showcasing future IP ahead of a fund raise.

Sectors Being Invested in

By comparison, the top three VC-funded sectors vs. the top three R&D tax claims are not aligned. In 2021, the UK saw Fintech, Health & Energy as most supported by VC. While HMRC paid out to Scientific & Technology, Manufacturing, and Information & Communications the most. This might be like comparing apples and pears, the VC data is made up of multiple companies each with multiple investors hoping to achieve returns amounting to billions, while HMRC is in the millions.

However, it could also showcase the return on investment for both parties. HMRC aims to support R&D with the intention of the companies work feeding back into the UK economy, while VCs are focused on securing returns for their private investors. Either way, it indicates where your best chance of securing investment lies if your business is looking to raise funds in any of those six industries. However, based off the data we have seen from both funding sources the differentiation in supported industries could simply lie in the difference of funder interests. The UK has to ensure the public purse is being well spent, while VC investors can support where they please and reap the rewards, but equally risk the uncertainty.

Conclusion.

In conclusion, both avenues are great sources of funding, both of which have contributed massively to making the UK one of the hottest spots for innovative technologies of all sizes and all sectors. Companies that are looking to secure funding can utilise it to maximise their benefit. However, from last year’s data, the investments in sectors from VC and HMRC are not aligned at the moment, which might be important to bear in mind if businesses are looking for funding in those industries.